To decentralize or not to decentralize

Editie: 31 - Global vs. Local

Published on: 07 juli 2024

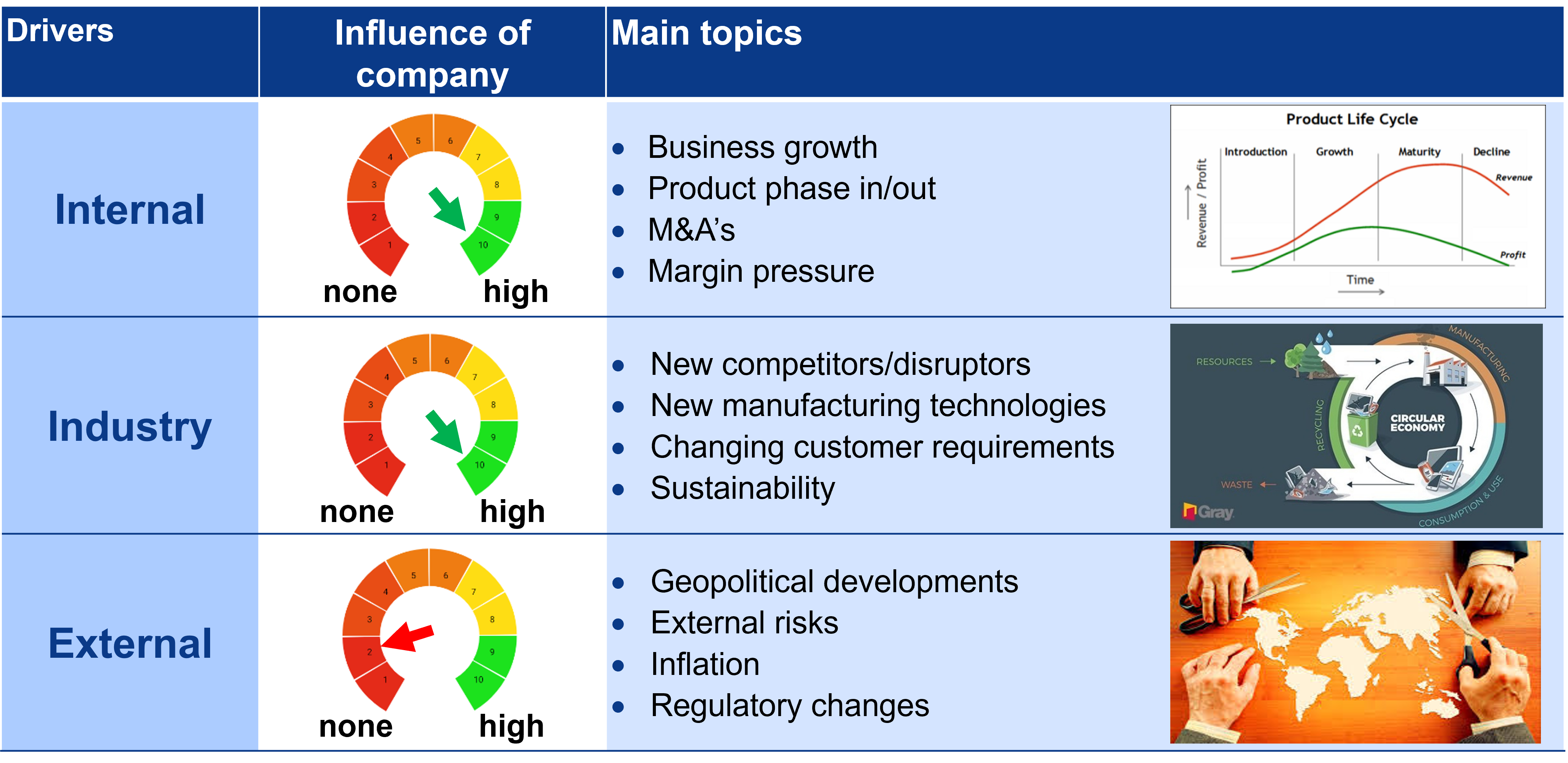

Manufacturing companies, globally, in different industries are reconsidering and optimizing their manufacturing strategies around the globe, asking themselves: are we still manufacturing in the right locations? How to support our business growth in the best possible way? How to mitigate risks in the current uncertain global landscape? How to become more sustainable in our value chains? Is decentralization, in this case referring to spreading manufacturing capacity out over the globe, the answer to this?

In this article, Buck Consultants International (BCI) presents key strategies that manufacturing companies are currently applying when preparing their manufacturing footprints for the future.

Companies follow the DE-strategy

BCI distinguishes 5 key strategies that companies are following in optimizing their global manufacturing footprints:

- DE-coupling China – Europe/US links

- DE-risking of global supply chains

- DE-single sourcing

- DE-centralization of production

- DE-carbonization

Throughout all five DE-strategies (DE referring here to moving away from, e.g. moving away from a single sourcing to a strategy of multiple sources), decentralization is often a key consideration, for example:

- Becoming less dependent on China by setting up production outside of China for fulfilling demand in different markets around the globe;

- Spreading global risks by producing critical products not anymore at only one global location but having production capacity in North America, Europe and Asia;

- Optimizing the supplier base by implementing dual sourcing strategies: having multiple suppliers to source the same important components or materials from;

- In line with the first two bullets: moving away from the concept of global factories to decentralized footprints with capacity on different continents;

- Shifting production capacities to locations where for example green energy is available.

50% of companies have already implemented decentralization of their manufacturing footprints

BCI conducted a survey on decentralization of manufacturing together with Supply Chain Magazine in the second half of 2023. 150 globally active manufacturing companies, mainly from Europe and the United States, participated in this survey.

A key result from the survey is that approximately 50% of the companies indicate that they already implemented decentralization in their manufacturing footprints in the past three years. In some companies this has been done so far for limited volumes (e.g. for critical products) and in other companies this impacted a much larger share of volume/capacity already.

Companies that shift manufacturing capacities from manufacturing locations in Asia to other parts of the world can either “near-shore” (setting up capacity in cost-effective locations near their main markets in Europe/North America) or “re-shore” (setting up capacity in their main markets in Europe/North-America).

The survey results show that in Europe on-shoring, so shifting capacity to locations on the European continent, is the prevailing concept. Companies shift capacities to locations in Western European countries more often than to countries like Turkey or Morocco. In North America near-shoring prevails, with many companies shifting capacities to countries such as Mexico and Costa Rica. In Asia itself near-shoring to countries like Vietnam, India, Malaysia is often preferred.

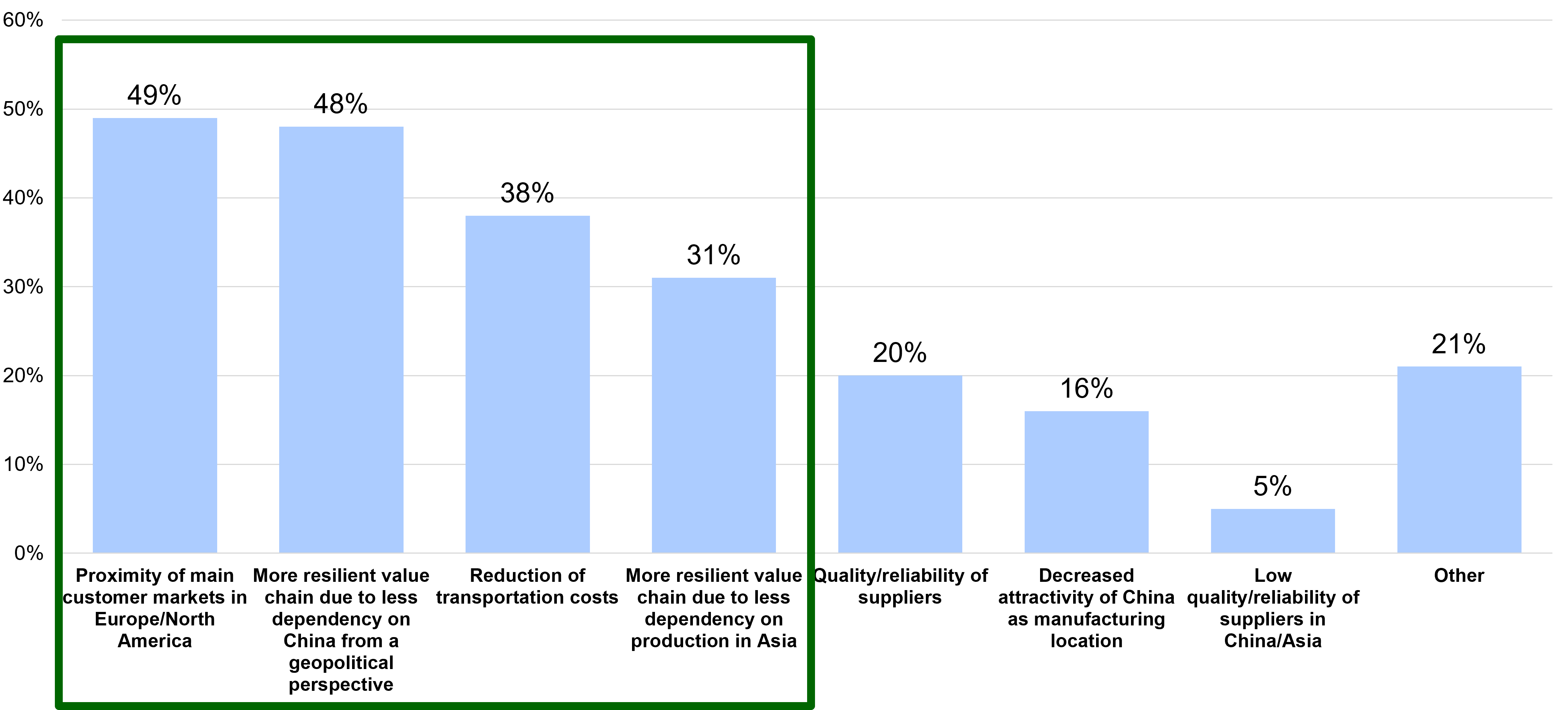

The key drivers for companies to implement these decentralization strategies are:

- Proximity to main markets in Europe and North America;

- Increased resilience in the global value chain by lower dependency on China and the rest of Asia;

- Reduction of transportation costs.

In terms of objectives realized in practice through these decentralization strategies most companies did achieve their expectations regarding proximity to markets and increased resilience. On the cost side almost 25% of companies is still struggling to achieve the cost reduction potential that was identified.

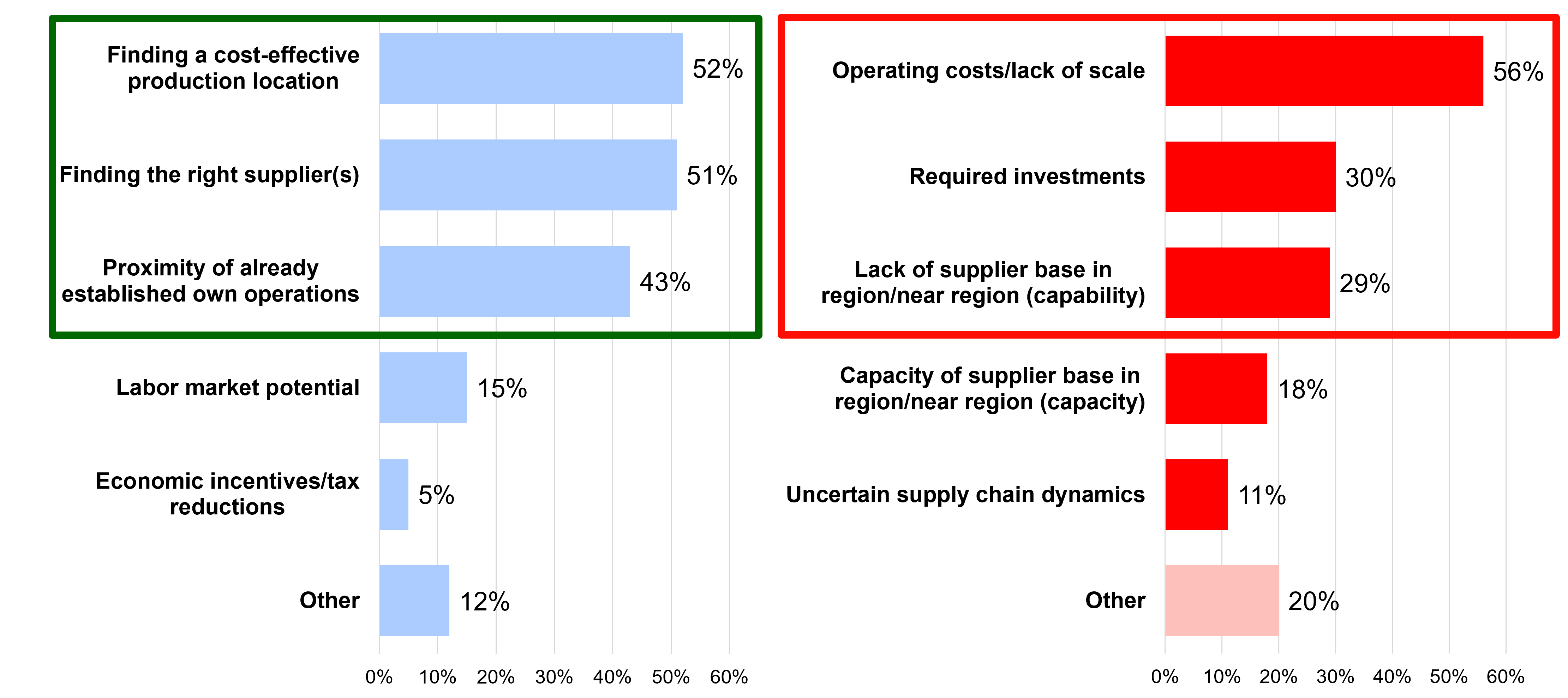

In our experience, key success factors for implementing decentralization in practice are the ability to find cost-effective locations to shift manufacturing capacities to (positive business case), finding the right supplier base in or close to the new manufacturing location(s) and the level to which companies already have existing facilities in e.g. Europe or North America. This was also confirmed by the survey results.

Figure 1. Strategic drivers for decentralization

An example of an industrial equipment manufacturer

BCI worked with a leading European industrial equipment manufacturer with a global manufacturing footprint. Although the company had manufacturing facilities around the globe, a first analysis of the current footprint led to the conclusion that in fact for a number of important products in the product portfolio the company depended for 100% on China.

Several scenarios were defined and analyzed, ranging from setting up an additional facility in Asia next to China (“China +1 strategy”) to full regionalization of manufacturing capacities for all product groups.

Driven by the need to reduce risks, become more resilient and sustainable, the company decided to implement a decentralized network of manufacturing plants for all main product groups with balanced capacities spread over plants in Europe, North America and Asia.

Figure 2. Drivers for Manufacturing Footprint Optimization

60% of companies are planning to decentralize in the coming three years

In the same survey 60% of companies reported they expect to be implementing decentralization measures in the coming three years.

Again, some expect to do this for significant shares of their global capacity and others are planning to do this in a more surgical way for specific critical product lines only. This highly depends on the specific profile of the company, its scale, product portfolio and also its geographical market spread.

The drivers for companies to have this intention to decentralize are comparable to those of companies that already acted: proximity, resilience and cost reduction.

In its global practice, BCI sees concrete examples of companies that are currently preparing for decentralization by analyzing different scenarios and developing a business case for decision-making. Multiple of these examples are companies that are analyzing the feasibility of shifting capacity from China to alternative location(s) whilst still ensuring to keep on manufacturing in China for the Chinese market. But there are also examples of companies that until now only manufacture in the United States (or Europe) and now want to spread risks by decentralizing capacities by setting up manufacturing in Asia and Europe (or North America). So, decentralization is not only about moving away from China/Asia. It is a strategy focused on optimizing the global manufacturing footprint by balancing capacities across the main global regions.

Figure 3. The key factors for success and main barriers for not considering nearshoring/onshoring.

To decentralize or not to decentralize?

If there are so many companies already decentralizing or analyzing the feasibility of it, why are not all companies decentralizing? And why are companies that do decentralize not doing this for 100% of their global manufacturing capacities?

This is because there are also clear barriers for decentralization:

- Operating costs / lack of scale

- Required investments

- Lack of a suitable supplier base

From an operating cost perspective, especially companies that are operating in a cost-sensitive industry, often historically manufacture in cost-effective locations. In many cases it is then challenging to find alternative locations in other parts of the world that can match this with a just as attractive cost base (labor costs, facility costs, taxes, etc.). In addition to that, decentralization often means splitting capacities over different locations, leading to a lower economy of scale per location than in the centralized situation. This impacts efficiency and therefore cost per unit produced.

Manufacturing changes always come with significant investments in new facilities, new equipment, write-offs of old equipment, etc. This needs to be factored into the business case and can be a clear barrier for companies.

Finally, as mentioned before, finding the right supplier base in new locations can be difficult as well. Take the example of the high-tech manufacturing industry that was built up over decades in China, with thousands of specialized suppliers. This supplier ecosystem cannot be copied in a short time period, if at all, to Europe or North America.

As BCI’s daily practice is showing, despite these barriers, decentralization is still a very interesting concept for globally active manufacturing companies. This was confirmed in the survey with Supply Chain Media as well.

In order to determine whether and in what exact way, the concept makes sense for an individual company a thorough fact-based analysis needs to be done, starting with a detailed mapping of the current state footprint (“AS-IS”) then defining relevant company-specific footprint scenarios and analyzing them in detail from the perspectives of costs (operating costs, capital expenditures, transition costs), qualitative aspects (labor availability, regulatory frameworks, logistics, supplier ecosystems, etc.) and risks (geopolitical, financial/economic, supply chain, natural disaster).

Only after such fact-based analysis a company can take a decision: to decentralize or not to decentralize?

On the author: Johan Beukema

| Johan Beukema is Managing Partner at BCI Global (Buck Consultants International), an independent consultancy firm specialized in manufacturing footprint strategy, location and site selection and supply chain optimization. Johan joined BCI in 1999 after his graduation in International Business Administration at the University of Groningen, The Netherlands. In these past 25 years he has supported numerous companies in their projects across EMEA, the Americas and Asia-Pacific including China. Johan is a member of the global Site Selectors Guild. |  |